Ireland VAT Invoice Requirements Step-by-Step Guide

Are you a business personnel in Ireland, and are you an accountable person? If yes, issuing VAT invoice in a specific period, VAT invoice requirements, who should file VAT invoice, and when. These questions will be in your mind. In this guide, Ireland VAT invoice requirements, I’ll discuss each aspect of Ireland’s VAT invoice in great detail and address these questions.

Who is an accountable person?

An accountable person or individual is a taxable person. In simple words, a person who supplies goods and services in the Irish State Stat and who is registered for VAT or meets the VAT registration requirements and is required to register for VAT is an accountable person.

Irish VAT Invoice

An Irish VAT invoice or value-added tax invoice is a document that is issued by an accountable person. It contains details related to the taxable supplies. Moreover, the invoice has all the necessary information per the VAT law.

Importance of Ireland VAT Invoice

Ireland VAT invoice is the base to determine VAT liability or VAT responsibility on the supply of goods/products or services. In addition, it helps your VAT-registered customers in reclaiming the VAT that you charged them.

Issuing Date of A VAT Invoice

Issuing of a VAT invoice must take place

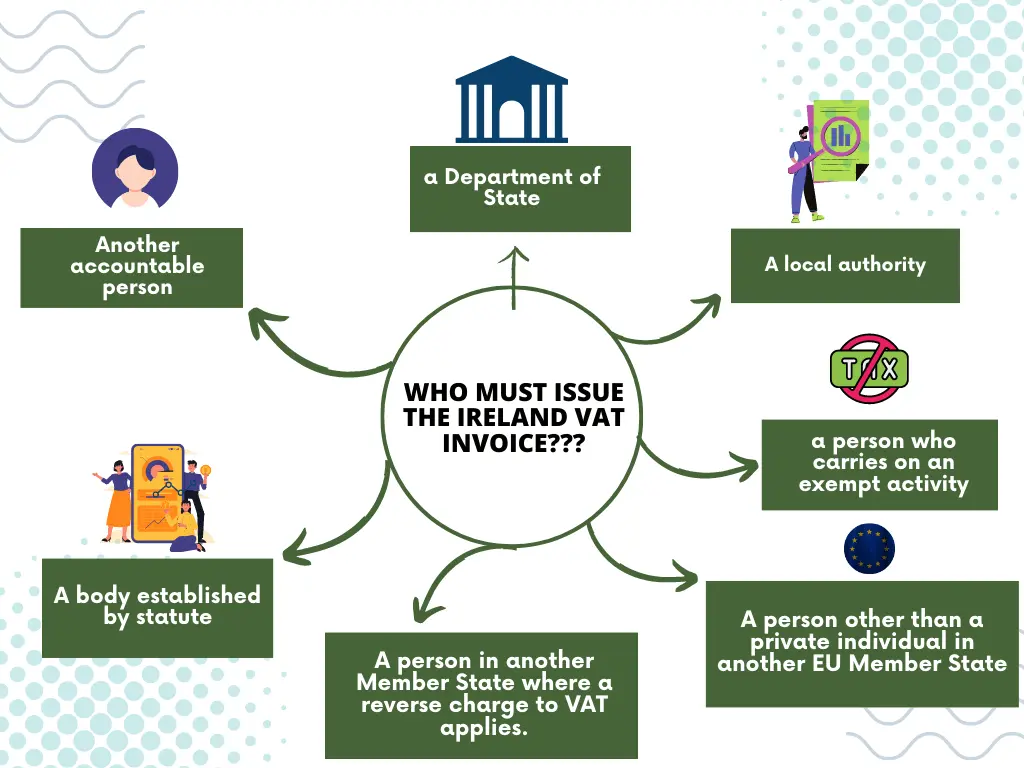

Who must issue the Ireland VAT invoice?

You’re an accountable person supplying goods or services to the following; you must issue Irish value-added tax invoice.

Who doesn’t have to issue Ireland VAT invoice?

A special set of rules apply to the supply of construction services, and the individuals lying in that position shouldn’t worry about the VAT invoice.

Irish VAT Invoice Requirements

The following are legal and valid VAT invoicing requirements in Ireland.

Date of issuance: The invoice’s date of issuanceshould be on the invoice.

Invoice Number: A unique invoice number or a unique sequential number.

Supplier’s Details: The address, name, and registration number of the supplier must be on the invoice.

Customer’s Details: The name and address of the customer must be on the invoice.

Customer’s VAT Number: Mention the customer’s VAT number if the invoice is for the reverse charge of supply and goods.

Intracommunity Trade: Mention the customer’s VAT number in case of intracommunity supply of goods. Mention it as an Intracommunity supply of goods on the invoice.

Goods and services Details: Do mention the quantity and nature of goods supplied and the extent and nature of the services rendered.

Description of Goods and Services: A full description of the goods/products should be mentioned on the VAT invoice.

Different Date of Supply: If the date of supply differs from the invoice date, mention it on the Ireland VAT invoice.

Price without VAT: Mention the unit’s VAT-exclusive price.

Net and Taxable Supply Value: Do mention the net and taxable value of the supply. Moreover, you can use our calculator to calculate the net and taxable supply value.

Discounts: Do mention the discounts or price reductions on the invoice.

VAT Rates: Mention the Vat rates on the invoice.

Gross amount: Mention the gross, total amount of the invoice.

Currency: The currency in which the payment is conducted should be mentioned on the VAT invoice.

Payment Terms: The payment terms and methods accepted by the seller should be outlined.

Margin Scheme or Special Scheme: For auctioneers, when the margin scheme or special scheme applies to the supply of goods, the amount payable shouldn’t be mentioned on the invoice.

The invoice concerning the margin scheme should be noted as the margin scheme – second-hand goods, and the invoice concerning the auctioneer’s scheme should be mentioned as the margin scheme – auction goods.

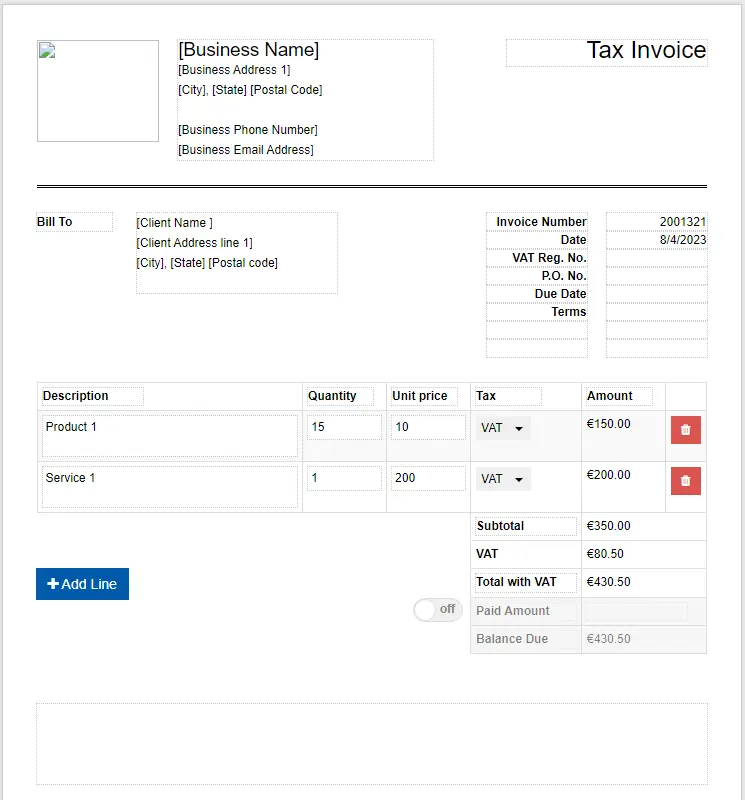

Irish VAT invoice Template

You can create an Irish VAT invoice with an Irish VAT invoice generator. You should upload your company’s logo, supplier’s and customers’ details, and all other necessary information.

Change in VAT Invoice

You can modify the VAT invoice if its information needs to be updated. If you raise the price of an item, you must submit a supplementary invoice that includes the price increase; it must be VAT exclusive, the applicable VAT rates, the amount of VAT at each rate, and a cross-reference to other invoice issued in connection with that supply.

If you reduce the price on the initial invoice, you should send a credit note to the customer to reflect the price reduction.

FAQs

Conclusion

Understanding Ireland’s VAT invoice requirements is fundamental for businesses conducting transactions in the country. Complying with these regulations ensures smooth operations, minimizes risks, and facilitates accurate tax reporting.

In this article, Ireland VAT invoice, I’ve addressed topics like what is VAT invoice, who is accountable person, who should issue a VAT invoice or not, Irish VAT invoicing requirements, and more. If you still have any queries, contact us.